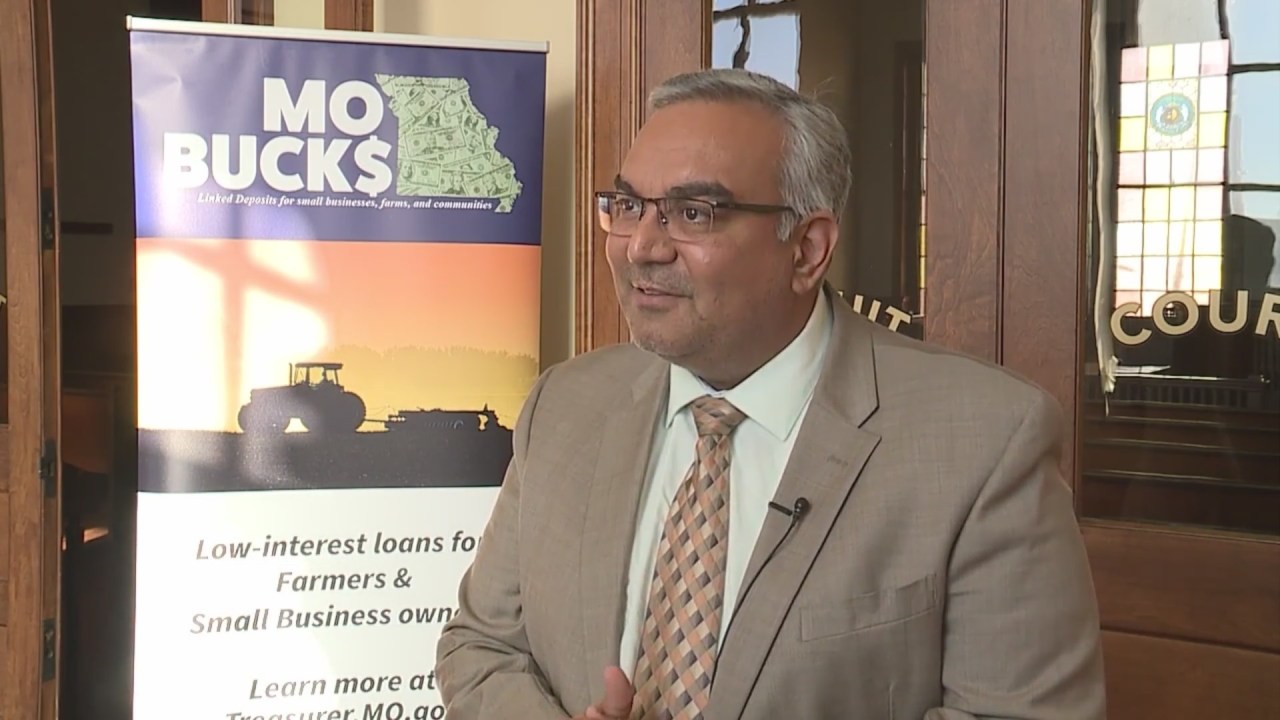

INDEPENDENCE, Mo. — Missouri State Treasurer Vivek Malek is making his way across the state, sharing more details about the MOBUCK$ loan program with community leaders and business owners.

The low interest rate loan program has been around for 40 years and allows lenders to lower a borrower’s interest rates by about 2-3%.

“If you are a small business and your profit margins are slim, that high interest rate can eat it up very quickly,” Malek said.

“And if you are able to lower that interest rate from 8.5 or 8.9% to 6% or 5.5%, that can be a huge difference maker for these small businesses to stay open and get through this tough phase.”

Through the program, the Missouri Treasurer’s Office partners with qualified-lending institutions to provide low-interest loans to help grow and expand economic opportunity across Missouri.

Malek said his office is working to increase the program’s impact for farmers and small business owners in 2024.

“We are again approaching legislature and encouraging them to raise the cap from $800 million to $1.2 billion, getting an infusion of another $400 million to see if that can help our small businesses across the state and our farmers who have been facing a tough situation lately,” Malek said.

Currently in Jackson County, recipients are using about $50 million in MOBUCK$ loans.

The Missouri Treasurer’s Office will start accepting new applications for the program starting Jan. 2, 2024.